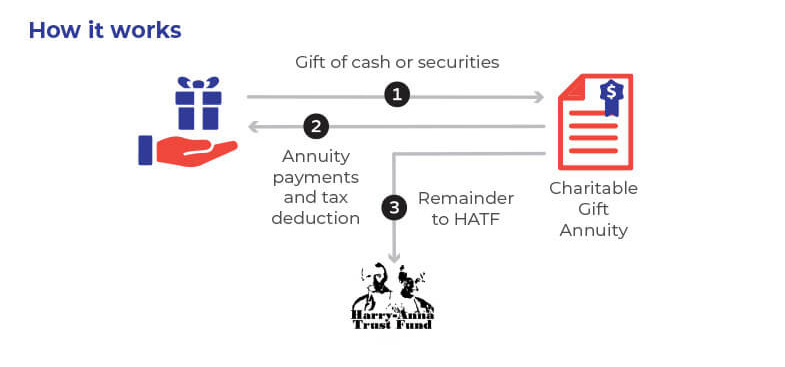

CHARITABLE GIFT ANNUITY

Benefits

-

In exchange for your gift HATF promises to make lifetime annuity payments to one or two annuitants.

-

The contractual obligation is backed by the National Gift Annuity Foundation (NGAF), making this a very secure source of future income.

-

After the death of the last annuitant, the balance of the remaining gift will be used by HATF for the purpose you’ve designated.

Did You Know?

-

Donors receive an income tax deduction based on the fair market value of the assets contributed less the present value of the future annuity payments.

-

Payments to annuitants are generally partly taxable as ordinary income and capital gain (depending on the gifted asset), and a portion is usually treated as a tax-free return of principal.

-

The Consolidated Appropriations Act of 2023 (Act) permits donors age 70½ or older to make a one-time qualified charitable distribution of up to $50,000 from their IRA to fund a charitable remainder trust or charitable gift annuity.

The Act outlines rules and restrictions that must be followed when making this type of gift. If you are interested in learning more, please contact HATF. You should also consult with your tax and financial advisors regarding this